Build Wealth and Feel Good Doing It

Invest With Us

Start Your Investing Journey Here

Why Consider Partnering with Us:

Proven Track Record: We have a successful history of delivering profitable real estate deals.

Local Expertise: Our team boasts deep knowledge of our target markets.

Swift Turnaround: We focus on short-term investments, ensuring a quick return on your capital.

Transparency: We believe in open and honest communication throughout the investment process.

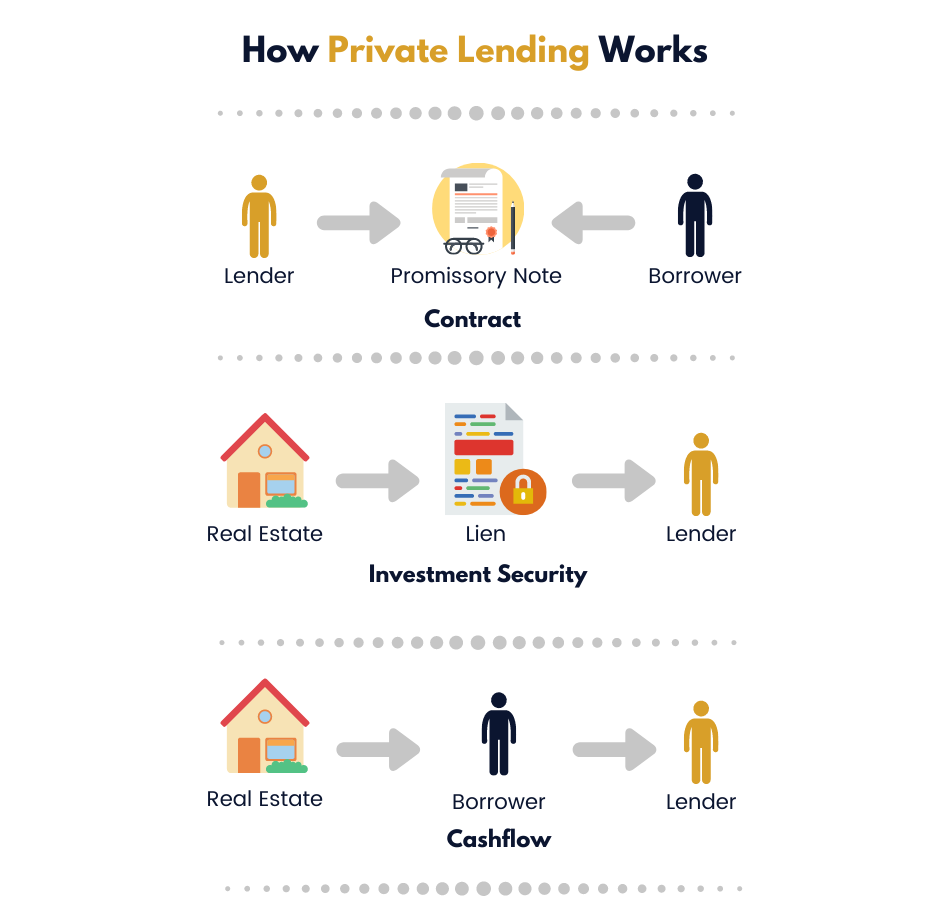

Private money lenders can be a valuable resource for real estate investors in several ways:

- Quick Access to Capital: Private money lenders can provide real estate investors with fast access to capital. Traditional financing from banks and financial institutions can involve a lengthy approval process, while private lenders can often fund deals in a matter of days or weeks.

- Flexible Loan Terms: Private money lenders offer more flexibility in terms of loan criteria. They are not bound by the same stringent regulations as banks, so they can tailor loan terms to meet the specific needs of the investor and the property.

- Financing for Non-Traditional Deals: Private money lenders are often willing to finance non-traditional real estate deals that might not qualify for conventional bank loans. These can include fix-and-flip projects, distressed properties, or investments with unconventional structures.

- Customized Financing: Private lenders can work with investors to create customized financing solutions. This may include interest-only loans, balloon payments, or other terms designed to align with the investor’s business plan.

- Creative Financing Options: Private money lenders may offer creative financing options, such as cross-collateralization, which can help investors leverage multiple properties to secure a loan.

- Relationship Building: Developing a relationship with a private money lender can lead to repeat business and ongoing partnerships. As investors demonstrate their ability to successfully complete projects and repay loans, lenders may become more willing to fund future deals.

- Bridge Financing: Private money lenders often provide bridge financing, which can be essential for investors looking to acquire a property quickly while securing long-term financing or making renovations.

- Funding for Riskier Ventures: Investors pursuing high-risk, high-reward projects may find that private money lenders are more willing to take calculated risks than traditional lenders. This can enable investors to pursue opportunities that might otherwise be out of reach.

Invest With Us

Start Your Investing Journey Here